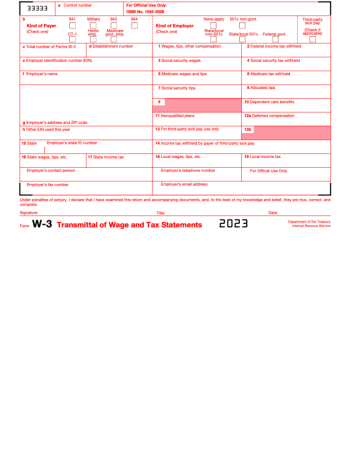

IRS W-3 Form

Get NowIRS Tax Form W-3: Key Takeaways

Preparing our taxes can sometimes feel a little confusing. Fear not. Help is at hand, especially when you need to take care of the IRS tax form W-3. In this article, we'll walk you through everything you need to know about this particular form.

Situations Requiring the IRS W-3 Form

Typically, employers use the IRS W3 form in 2023 to report wage and tax information. But there are uncommon situations where you might need it. For instance, you may be an entrepreneur who just hired your first employee, or you might be managing payroll for the first time.

- In case of a new business, it’s recommended to consult with a tax professional early on to ensure you are filing correctly.

- If you've undertaken the role of payroll management, educate yourself about the necessary tax forms, starting with W-3. Online resources and workshops can be highly beneficial in this case.

Fixing Errors on IRS W-3 Tax Form

No need to panic if you've realized a mistake regarding how to fill out IRS Form W-3. Blank columns should not be a worry, as the IRS has solutions in place. Remember, it's better to address any errors head-on and correct them effectively rather than ignoring them.

- First, read the instructions provided by the IRS again. It may help in rectifying common mistakes when filling out the form.

- Consulting a tax professional is often a worthwhile investment.

The Significance of Form W-3 for Employees

The W-3 form might seem like an employer-exclusive requirement, but it plays an important role for employees as well. This form represents part of an employee’s vital tax documents that record income and withholding. While employees won't need the IRS W-3 printable form directly, knowing about it can help in understanding their individual reporting process and ensuring they have all the necessary documents.

Federal Form W3: Frequently Asked Questions

Here are some commonly asked questions:

- Can you correct a W-3 after filing?

Yes, using a process called "amended return." - What happens if I don't file a W-3?

You might face penalties as it’s legally required. Consult a tax professional if you believe you don't need to file. - Can I find a printable IRS Form W3 for 2022?

Yes, you can download and print this form by following the link from our website.

While dealing with tax forms can seem daunting, with the right knowledge and resources, you can navigate through this process more effectively. Always remember, when in doubt, consult a tax professional.

Related Forms

-

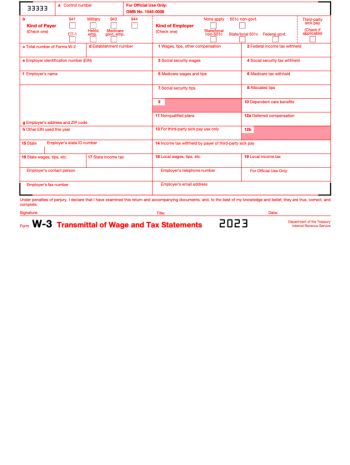

![image]() W-3 Form W-3 is a document used by employers in the USA. Simply put, the W-3 transmittal form acts as a summary of all the W-2 forms that employers have issued to their employees throughout the year, showing the total earnings, Social Security wages, Medicare wages, and tax withholdings. It is crucial to submit the Form W-3 along with copies of all W-2 copies to the Social Security Administration (SSA) at the end of each tax year. Fill Now

W-3 Form W-3 is a document used by employers in the USA. Simply put, the W-3 transmittal form acts as a summary of all the W-2 forms that employers have issued to their employees throughout the year, showing the total earnings, Social Security wages, Medicare wages, and tax withholdings. It is crucial to submit the Form W-3 along with copies of all W-2 copies to the Social Security Administration (SSA) at the end of each tax year. Fill Now -

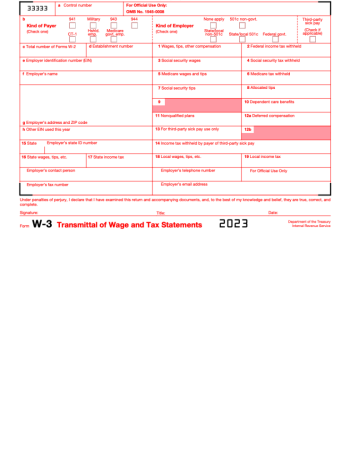

![image]() Fillable W3 Form Before discussing a fillable W3 form in 2023, it's essential to understand this document. Created by the Internal Revenue Service of the United States, IRS Form W-3 serves as a transmittal form for different wage and tax statements, such as W-2 forms. Employees, as well as employers, use this form for reporting annual wages and withholding information. Although it may seem daunting, understanding how to fill out and submit this paperwork can make the tax filing process simpler. The Fillable Form W-3 and Its Perks Opting for a fillable format can make completing this paperwork more comfortable. An IRS Form W-3 fillable lets you enter all the relevant information directly from your computer. Besides ease, this option ensures accuracy, as the built-in formulas in the digital version can automatically calculate sums, reducing the chances of making errors. It also eliminates the worry of illegible handwriting, enhancing the readability of the IRS. Overcoming Online Submission Challenges Despite its advantages, filing the 2022 W3 fillable form online may have a learning curve. Acknowledge the learning curve: Be aware that navigating the online filing process might pose challenges, especially in identifying the correct fields to fill and avoiding typographical errors. Prioritize meticulous checksBefore submitting the form, invest time in thoroughly rechecking the content and verifying all entries to ensure accuracy and prevent potential complications. Seek professional guidanceDon't hesitate to consult with a tax professional or expert if you encounter doubts or uncertainties during the online filing process. Ensure comprehensive understandingRecognize that tax matters are complex and seek professional assistance to navigate intricacies, ensuring a smooth and error-free filing experience. Mitigate financial risksUnderstand that errors or oversights in the filing process could lead to unintended financial consequences, emphasizing the importance of seeking expert advice and guidance. Guidelines for Successful Form Completion While dealing with the free fillable W3 form for 2022, follow a systematic approach. Gather all necessary information, including your Employer Identification Number (EIN) and the total number of W-2 forms. Next, provide detailed wage and tax information for the year in question. Be cautious while reporting withheld federal income tax to avoid discrepancies. Keeping Your Personal Data Safe When handling information on the free W3 fillable form for 2022, paying attention to cybersecurity is crucial. To minimize the risk of a data breach, never share your screens or paperwork containing your personal information with anyone. Use trusted websites to download or access these forms and ensure any uploaded data remains confidential. Following these safety measures can keep your personal and financial information secure. Even though taxes might seem intimidating, access to forms like the fillable Form W-3 simplifies the process. By being diligent and careful, one can quickly complete and submit tax documents, paving the way toward easy tax filing. Fill Now

Fillable W3 Form Before discussing a fillable W3 form in 2023, it's essential to understand this document. Created by the Internal Revenue Service of the United States, IRS Form W-3 serves as a transmittal form for different wage and tax statements, such as W-2 forms. Employees, as well as employers, use this form for reporting annual wages and withholding information. Although it may seem daunting, understanding how to fill out and submit this paperwork can make the tax filing process simpler. The Fillable Form W-3 and Its Perks Opting for a fillable format can make completing this paperwork more comfortable. An IRS Form W-3 fillable lets you enter all the relevant information directly from your computer. Besides ease, this option ensures accuracy, as the built-in formulas in the digital version can automatically calculate sums, reducing the chances of making errors. It also eliminates the worry of illegible handwriting, enhancing the readability of the IRS. Overcoming Online Submission Challenges Despite its advantages, filing the 2022 W3 fillable form online may have a learning curve. Acknowledge the learning curve: Be aware that navigating the online filing process might pose challenges, especially in identifying the correct fields to fill and avoiding typographical errors. Prioritize meticulous checksBefore submitting the form, invest time in thoroughly rechecking the content and verifying all entries to ensure accuracy and prevent potential complications. Seek professional guidanceDon't hesitate to consult with a tax professional or expert if you encounter doubts or uncertainties during the online filing process. Ensure comprehensive understandingRecognize that tax matters are complex and seek professional assistance to navigate intricacies, ensuring a smooth and error-free filing experience. Mitigate financial risksUnderstand that errors or oversights in the filing process could lead to unintended financial consequences, emphasizing the importance of seeking expert advice and guidance. Guidelines for Successful Form Completion While dealing with the free fillable W3 form for 2022, follow a systematic approach. Gather all necessary information, including your Employer Identification Number (EIN) and the total number of W-2 forms. Next, provide detailed wage and tax information for the year in question. Be cautious while reporting withheld federal income tax to avoid discrepancies. Keeping Your Personal Data Safe When handling information on the free W3 fillable form for 2022, paying attention to cybersecurity is crucial. To minimize the risk of a data breach, never share your screens or paperwork containing your personal information with anyone. Use trusted websites to download or access these forms and ensure any uploaded data remains confidential. Following these safety measures can keep your personal and financial information secure. Even though taxes might seem intimidating, access to forms like the fillable Form W-3 simplifies the process. By being diligent and careful, one can quickly complete and submit tax documents, paving the way toward easy tax filing. Fill Now -

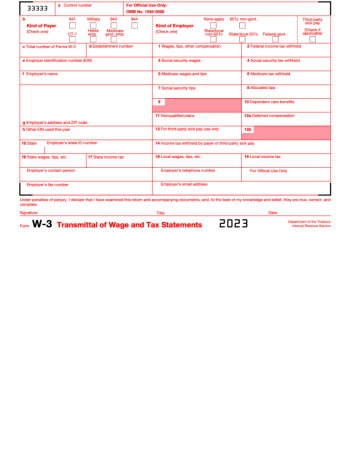

![image]() Printable W-3 Form Before setting out to fill in your tax forms, it's crucial to familiarize yourself with the layout of the form. The IRS Form W-3 printable is a concise document, yet it contains significant fields that must be accurately filled out. Key sections include the employer's identification number (EIN), total wages paid, federal income tax withheld, and social security or Medicare tax withheld. Complete the Printable W-3 Form Step-by-Step Understanding all the terms and numbers on a tax form can be, understandably, a little overwhelming. Below, you'll find a simplified guide with practical steps to help you correctly fill out the printable W3 form, minimizing stress and ensuring accuracy. Locate your Employer Identification Number (EIN) and write it in the designated space. Record the total amount of wages, tips, and other compensation paid to employees over the year in the relevant box. Next, input the total federal income tax withheld over the period. Lastly, indicate the total amount of social security or Medicare tax withheld during the course of the year. Submitting Form W3 in 2023 Once you've successfully completed the printable form, the next step is to submit it appropriately. It's crucial that you precisely follow the prescribed format for submission to avoid incurring penalties or experiencing unnecessary delays. Fortunately, this is an easy process, and you can mail your completed W3 form printable for free to the Social Security Administration. Ensure to include all related W2 forms. Remember to append your signature where necessary before mailing. Important Submission Deadlines Having a grasp on required deadlines is crucial to avoid last-minute rushes or possible penalties. Please remember that the deadline to complete and submit your IRS Form W-3 printable is January 31, 2023. Failing to meet this deadline can have ramifications that extend far beyond the immediate inconvenience of rushing to file your forms at the last minute. Penalties imposed by the IRS for late submissions are a genuine concern. It's important to underscore that these penalties can have a real impact on your financial bottom line, potentially resulting in unnecessary expenses that could otherwise be avoided. To maintain a proactive and compliance-oriented approach, it is strongly recommended that you take the prudent step of marking this critical January 31st deadline on your calendars well in advance. Understanding the format, correctly filling, and timely submission of your IRS Form W-3 printable can help mitigate unnecessary stress during the tax season. Remember, it pays, literally and figuratively, to stay ahead of your tax obligations! Stay informed, stay compliant. Fill Now

Printable W-3 Form Before setting out to fill in your tax forms, it's crucial to familiarize yourself with the layout of the form. The IRS Form W-3 printable is a concise document, yet it contains significant fields that must be accurately filled out. Key sections include the employer's identification number (EIN), total wages paid, federal income tax withheld, and social security or Medicare tax withheld. Complete the Printable W-3 Form Step-by-Step Understanding all the terms and numbers on a tax form can be, understandably, a little overwhelming. Below, you'll find a simplified guide with practical steps to help you correctly fill out the printable W3 form, minimizing stress and ensuring accuracy. Locate your Employer Identification Number (EIN) and write it in the designated space. Record the total amount of wages, tips, and other compensation paid to employees over the year in the relevant box. Next, input the total federal income tax withheld over the period. Lastly, indicate the total amount of social security or Medicare tax withheld during the course of the year. Submitting Form W3 in 2023 Once you've successfully completed the printable form, the next step is to submit it appropriately. It's crucial that you precisely follow the prescribed format for submission to avoid incurring penalties or experiencing unnecessary delays. Fortunately, this is an easy process, and you can mail your completed W3 form printable for free to the Social Security Administration. Ensure to include all related W2 forms. Remember to append your signature where necessary before mailing. Important Submission Deadlines Having a grasp on required deadlines is crucial to avoid last-minute rushes or possible penalties. Please remember that the deadline to complete and submit your IRS Form W-3 printable is January 31, 2023. Failing to meet this deadline can have ramifications that extend far beyond the immediate inconvenience of rushing to file your forms at the last minute. Penalties imposed by the IRS for late submissions are a genuine concern. It's important to underscore that these penalties can have a real impact on your financial bottom line, potentially resulting in unnecessary expenses that could otherwise be avoided. To maintain a proactive and compliance-oriented approach, it is strongly recommended that you take the prudent step of marking this critical January 31st deadline on your calendars well in advance. Understanding the format, correctly filling, and timely submission of your IRS Form W-3 printable can help mitigate unnecessary stress during the tax season. Remember, it pays, literally and figuratively, to stay ahead of your tax obligations! Stay informed, stay compliant. Fill Now -

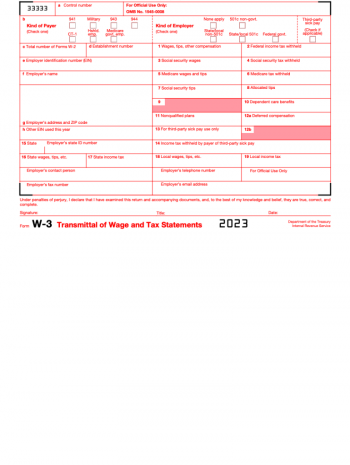

![image]() W-3 Tax Form The W-3 tax form, officially known as the "Transmittal of Wage and Tax Statements," is an essential document in the United States tax system. Unlike individual tax forms, it serves a particular purpose for employers. This federal tax form W-3, essentially acts as a summary report, which complements the series of W-2 copies that employers distribute to their employees. The information on these forms includes total earnings, Social Security wages, Medicare wages, and withheld taxes. For correct filing, the employer must submit this form to the Social Security Administration, not the Internal Revenue Service (IRS). Who Should Not Use the W-3 Tax Form? Understanding who should not use the form can be truly beneficial in the long run. Here is the list: Independent contractors who receive payment through the 1099 form. Employers who only distribute the 1099 form are not required to file a 2022 W3 tax form. It's worth noting that the form applies to both paper and electronic submissions. Also, each set of W-2s submitted must have the corresponding W-3 form, which is contrary to the belief that only one W-3 should be submitted per tax year. In Practice: Filling out a W-3 Tax Form Let's use a hypothetical example to illustrate how a business would use the W-3 tax form. Suppose you run a small business with ten employees. Each of them receives a W-2 outlining their earnings and taxes for the year. At the end of the year, you'll combine all of the data from these W-2 copies into one tax form W-3 for 2022. This annotated summary gives the SSA an overview of all wages and taxes associated with your business for the past year. And, of course, make sure that each employee receives a copy of their W-2! Common W-3 Tax Form Instructions Issues and Solutions Common Issue Solution Incorrect Employee Social Security Numbers (SSNs) Ensure that the SSN provided on the W-2 form matches the employee's Social Security card. If there's a discrepancy, ask the employee to provide the correct information and update the W-2 accordingly. The SSNVS allows employers to verify employee SSNs with the Social Security Administration. This can help prevent inaccuracies in the future. Maintain precise employee records with correct SSNs to prevent errors in the first place. Regularly update your records as needed. Mismatched Totals between W-2 and W-3 Forms Double-check the totals on each W-2 form to ensure they accurately represent the individual employee's earnings, deductions, and taxes withheld. Sum the corresponding figures on the W-2 forms to ensure the totals on the W-3 form match. Specifically, compare the following: Total wages, tips, and other compensation. Total federal income tax withheld Total Social Security wages. Total Medicare wages and tips. Utilize payroll software that can automatically generate the W-3 form based on the information entered for each employee. This reduces the risk of calculation errors. If discrepancies are identified, reconcile the differences by amending the W-2 forms with the correct figures. Then, update the W-3 form to match the corrected W-2s. Understanding these common issues can prevent needless errors and save you precious time and resources during the tax season. We hope this W3 tax form instructions benefit you and will help make the tax process more manageable. Fill Now

W-3 Tax Form The W-3 tax form, officially known as the "Transmittal of Wage and Tax Statements," is an essential document in the United States tax system. Unlike individual tax forms, it serves a particular purpose for employers. This federal tax form W-3, essentially acts as a summary report, which complements the series of W-2 copies that employers distribute to their employees. The information on these forms includes total earnings, Social Security wages, Medicare wages, and withheld taxes. For correct filing, the employer must submit this form to the Social Security Administration, not the Internal Revenue Service (IRS). Who Should Not Use the W-3 Tax Form? Understanding who should not use the form can be truly beneficial in the long run. Here is the list: Independent contractors who receive payment through the 1099 form. Employers who only distribute the 1099 form are not required to file a 2022 W3 tax form. It's worth noting that the form applies to both paper and electronic submissions. Also, each set of W-2s submitted must have the corresponding W-3 form, which is contrary to the belief that only one W-3 should be submitted per tax year. In Practice: Filling out a W-3 Tax Form Let's use a hypothetical example to illustrate how a business would use the W-3 tax form. Suppose you run a small business with ten employees. Each of them receives a W-2 outlining their earnings and taxes for the year. At the end of the year, you'll combine all of the data from these W-2 copies into one tax form W-3 for 2022. This annotated summary gives the SSA an overview of all wages and taxes associated with your business for the past year. And, of course, make sure that each employee receives a copy of their W-2! Common W-3 Tax Form Instructions Issues and Solutions Common Issue Solution Incorrect Employee Social Security Numbers (SSNs) Ensure that the SSN provided on the W-2 form matches the employee's Social Security card. If there's a discrepancy, ask the employee to provide the correct information and update the W-2 accordingly. The SSNVS allows employers to verify employee SSNs with the Social Security Administration. This can help prevent inaccuracies in the future. Maintain precise employee records with correct SSNs to prevent errors in the first place. Regularly update your records as needed. Mismatched Totals between W-2 and W-3 Forms Double-check the totals on each W-2 form to ensure they accurately represent the individual employee's earnings, deductions, and taxes withheld. Sum the corresponding figures on the W-2 forms to ensure the totals on the W-3 form match. Specifically, compare the following: Total wages, tips, and other compensation. Total federal income tax withheld Total Social Security wages. Total Medicare wages and tips. Utilize payroll software that can automatically generate the W-3 form based on the information entered for each employee. This reduces the risk of calculation errors. If discrepancies are identified, reconcile the differences by amending the W-2 forms with the correct figures. Then, update the W-3 form to match the corrected W-2s. Understanding these common issues can prevent needless errors and save you precious time and resources during the tax season. We hope this W3 tax form instructions benefit you and will help make the tax process more manageable. Fill Now -

![image]() 2023 Form W-3 Welcome! Let's tackle a significant aspect of taxation in the United States, the 2023 Form W-3. The form isn't as complicated as it may seem, so just relax, and let's walk through it together. Form W-3, also known as the 'Transmittal of Wage and Tax Statements', is a summary report generated by employers at the end of a financial year. Essentially, this form accumulates all the information from Form W-2, which pertains to income taxes withheld from an employee's paycheck. This information is then sent to the Social Security Administration (SSA) along with the W-2 forms. Changes to IRS Form W-3 In recent years, a few fundamental changes have been made to the IRS W3 form 2023 in respect to the rules of filing and the structure of the form itself. The form is now designed for easier reading and processing by OCR (Optical Character Recognition) technology. It can also accommodate more detailed coding in relation to Medicare tax withheld in excess. However, the basic structure remains: the form still reports wages, tips, and other compensation, Social Security wages, and Medicare wages and tips. IRS W-3 Form & Employers Who Need It Generally, any employer who disburses salaries, wages, or other forms of compensation to an employee must file Form W-3. However, it doesn’t apply to all income. For instance, payments to non-employee workers, real estate rents, or royalties do not require a 2023 W3 form. The form is essentially for employers who have provided Form W-2 to their employees. Noteworthy here is that only the original or a printable W3 form for 2023 can be sent to the SSA. Photocopies are not acceptable. The forms must be typewritten, without erasures or handwritten values, and the accuracy of all entries must be ensured before submission. Tips for Filling Form W-3 If you're unsure about filling out the form correctly, you can consider using a fillable Form W3 for 2023. This digital version of the form makes it easier to submit accurate reports to the SSA. This platform offering automated entries ensures fewer errors and unmatched convenience. Simply enter the relevant information in the indicated fields, and the system takes care of the rest. Remember, all W-2 forms for a single employer must be accompanied by a single W-3 form. This critical action summarizes your total wages and other compensations for the IRS. So, preparation and precision are key to an optimal form-filling process. Stay organized, keep things simple, and aim for accuracy! Fill Now

2023 Form W-3 Welcome! Let's tackle a significant aspect of taxation in the United States, the 2023 Form W-3. The form isn't as complicated as it may seem, so just relax, and let's walk through it together. Form W-3, also known as the 'Transmittal of Wage and Tax Statements', is a summary report generated by employers at the end of a financial year. Essentially, this form accumulates all the information from Form W-2, which pertains to income taxes withheld from an employee's paycheck. This information is then sent to the Social Security Administration (SSA) along with the W-2 forms. Changes to IRS Form W-3 In recent years, a few fundamental changes have been made to the IRS W3 form 2023 in respect to the rules of filing and the structure of the form itself. The form is now designed for easier reading and processing by OCR (Optical Character Recognition) technology. It can also accommodate more detailed coding in relation to Medicare tax withheld in excess. However, the basic structure remains: the form still reports wages, tips, and other compensation, Social Security wages, and Medicare wages and tips. IRS W-3 Form & Employers Who Need It Generally, any employer who disburses salaries, wages, or other forms of compensation to an employee must file Form W-3. However, it doesn’t apply to all income. For instance, payments to non-employee workers, real estate rents, or royalties do not require a 2023 W3 form. The form is essentially for employers who have provided Form W-2 to their employees. Noteworthy here is that only the original or a printable W3 form for 2023 can be sent to the SSA. Photocopies are not acceptable. The forms must be typewritten, without erasures or handwritten values, and the accuracy of all entries must be ensured before submission. Tips for Filling Form W-3 If you're unsure about filling out the form correctly, you can consider using a fillable Form W3 for 2023. This digital version of the form makes it easier to submit accurate reports to the SSA. This platform offering automated entries ensures fewer errors and unmatched convenience. Simply enter the relevant information in the indicated fields, and the system takes care of the rest. Remember, all W-2 forms for a single employer must be accompanied by a single W-3 form. This critical action summarizes your total wages and other compensations for the IRS. So, preparation and precision are key to an optimal form-filling process. Stay organized, keep things simple, and aim for accuracy! Fill Now